An approach, not a calculator

Market sizing in the Buyer-Based program does not include one-size fits all calculator. The example below follows the market sizing lesson in the book. This approach can be modified to fit almost any industry type and for any series of products. This bottom-up approach looks at your products and how they are used and relies on the information you already know about current customers or information that you can find online about your market (in the event you have no matching customers).

In this system, when we refer to market size, we are talking about how much potential opportunity for your product exists. In the Buyer-Based Marketing system, I try to avoid over-complicated language or approaches that cause more headache and don’t get much done. We don’t go into Addressable Market, Serviceable-Obtainable Market, or any other term that’s used on Wikipedia – although you should probably know what those terms are if you’re going to be presenting this to your bosses.

Below, I will show you an example of how I would set up a spreadsheet for market sizing two different types of products. In the book, I go into some detail about how I collect the information that I need to get the math right, and how to use current customer information to figure out exactly how big a market might be for you.

(The Google Sheet with both tabs is available here: Market Sizing Spreadsheet Example)

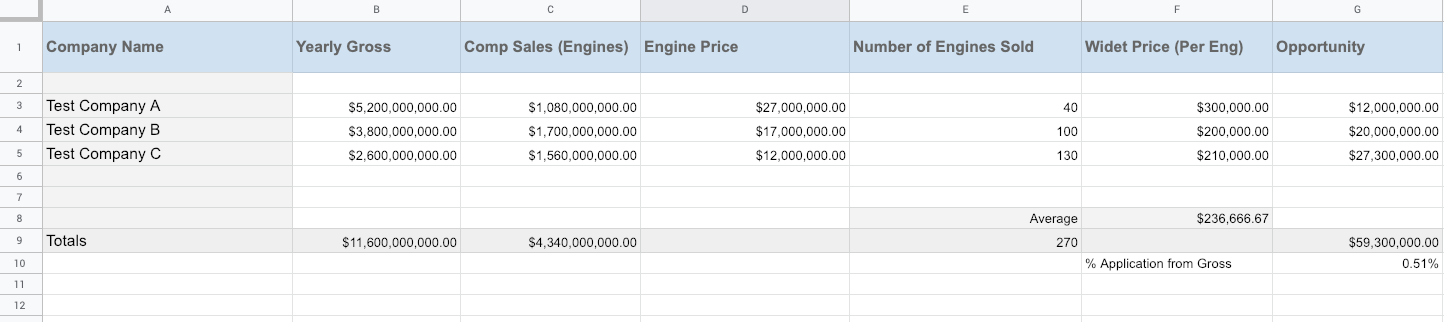

First Example

The first example is selling a widget to another company who has public sales information available. For instance, if you were selling that widget to GE and the product was going into aircraft engines.

This example is one of the easier ones to follow. It starts with the company’s yearly revenue. A search will also need to be performed for information about the sales dollars associated with the components we fit into. If we follow the engine idea in the chart above, we see that Company A has $5.2B of revenue, with $1B of that coming from engines. Also, we know the estimated price of those engines as $27M. An assumption can now be made – they have sold 40 engines. We also know that we could get about $300K for each engine manufactured(we make a nice widget). That means our opportunity is $12M.

The second two companies are also companies that we could do future business with – we can average all of what we know to get a % number. We can then apply that average % number to the other companies in the market that we do not do business with, giving us a market size.

Second Example

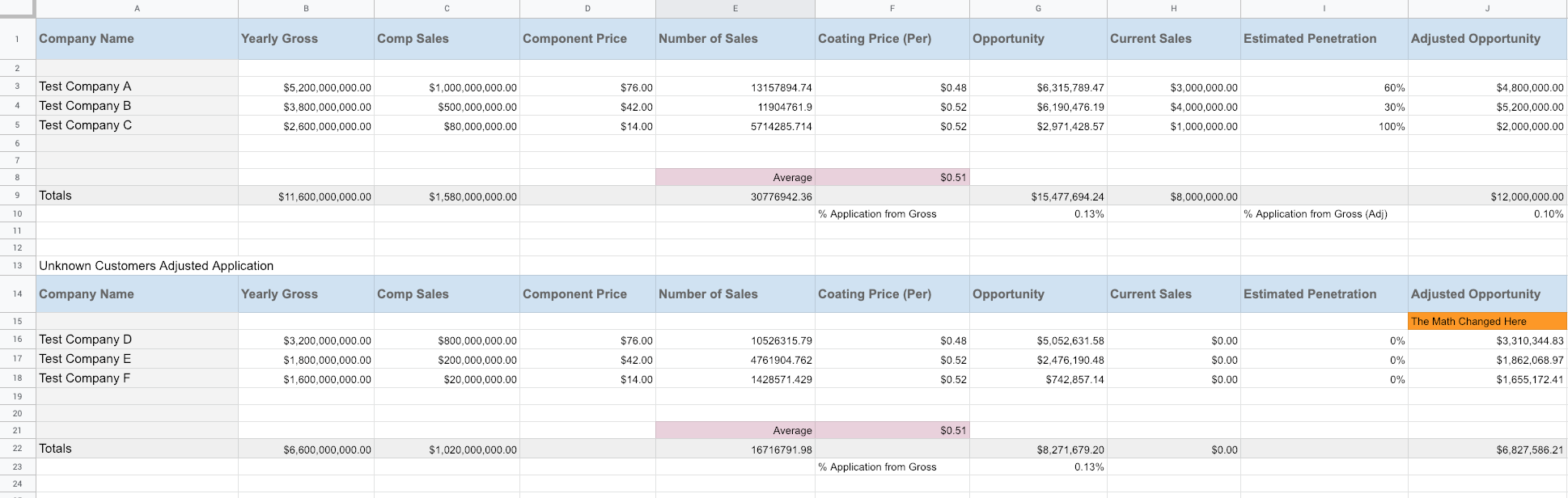

The second example is sizing a market where you have a little bit more information about existing customers. We’ll say that you are selling a specialized coating that goes in an electrical component, and you already sell a lot of it to a few different types of companies.

In this sheet we two sets of customers. The first set represents customers that we currently do business with, and know about how much of their potential business we have (this particular scenario is common with dual-supply agreements).

We record their yearly revenue, and their component sales dollars – the amount of money they make from any product that we could be a part of). Also recorded is the component price, the number of sales of their component, and our price per unit of their component. If you don’t follow that, think of it like this: We need to take their total sales dollars for any unit they sell that we can be a part of. Then we figure out how many they sell and how much we can make off of each of their component (unit) sales.

After that, apply the current sales dollar number with our estimated penetration into their company. Multiplying the current sales by the estimated penetration gives us an adjusted opportunity number. Compare the percentage of that number to our previous math (the opportunity column) to see if we’re in the right range. I almost exclusively rely on the adjusted opportunity number to generate my market size reports; however, it can be beneficial to see both.

Once I am confident in my percentage, I apply the multiplier to all of the companies that I do not do business with, giving me a pretty accurate representation of what my market opportunity is.

Stay Flexible

I never approach market sizing as something that can be figured out with a calculator, too many variables exist. Harvard Business Review has a pretty good calculator that can be applied to something like selling shoes, but it doesn’t work well when you’re looking at selling to another business. We have to account for a lot of guesswork, that’s where this type of approach can help you.